In today’s fast-paced financial world, finding a reliable and intuitive platform to manage your investments can be challenging. GoMyFinance Invest stands out as a comprehensive solution for those seeking to take control of their financial future. With its user-friendly interface and diverse investment options, GoMyFinance Invest provides the tools and resources needed to make informed decisions that align with your financial goals.

Whether you’re a beginner looking to dip your toes into the world of investing or an experienced investor seeking advanced features, GoMyFinance Invest offers something for everyone. The platform’s focus on personalized investment strategies and automated tools makes it easier than ever to build and manage a portfolio that suits your risk tolerance and long-term objectives.

Moreover, GoMyFinance Invest is more than just a platform—it’s a partner in your financial journey. From robust educational resources to innovative financial planning tools, this platform empowers you to make the most of your investments, ensuring you’re always on the right path towards financial success.

Getting Started with GoMyFinance Invest: A Step-by-Step Guide

Create Your Account

To begin with GoMyFinance Invest, you need to set up an account. Start by visiting the GoMyFinance Invest website and click on the “Sign Up” button. Enter your basic details, such as your name, email address, and phone number. After you’ve submitted this information, you will receive an email to verify your account. Click on the verification link in the email to complete the registration process and activate your account.

Set Up Your Investment Profile

Once your account is active, you will need to set up your investment profile. GoMyFinance Invest will ask you questions about your financial goals, how much risk you are willing to take, and your investment preferences. This helps the platform recommend investments that are right for you. You can choose to manage your investments yourself or use the automated investing feature, where the platform handles the investments based on your profile.

Fund Your Account and Start Investing

With your profile set up, it’s time to fund your account. Link your bank account to GoMyFinance Invest and transfer money into your investment account. Once your funds are available, you can start exploring the investment options. Look through choices like stocks, bonds, and mutual funds. Select the ones that match your goals and preferences, and start building your investment portfolio.

Monitor and Adjust Your Investments

After you’ve made your investments, keep track of your portfolio’s performance. GoMyFinance Invest provides tools to help you monitor your investments and make changes if needed. Regularly reviewing your investments will help you stay on track with your financial goals and make adjustments as your needs change.

Exploring the Key Features of GoMyFinance Invest for New Investors

GoMyFinance Invest is ideal for new investors, offering a user-friendly dashboard that clearly tracks investments, comprehensive educational resources to simplify financial concepts, and personalized advice tailored to individual goals and risk levels. These features make the platform a supportive starting point for anyone beginning their investment journey.

Key Features of GoMyFinance Invest for New Investors

- User-Friendly Dashboard

- GoMyFinance Invest offers a simple and intuitive dashboard that allows you to view all your investments in one place.

- The dashboard provides a clear overview of your total investments, current performance, and suggested next steps.

- Educational Resources

- The platform is packed with educational tools designed specifically for beginners.

- Access tutorials, articles, and videos that break down complex financial concepts into easy-to-understand language.

- Learn about various investment options, like invest in mutual funds, and discover how to balance your portfolio effectively.

- Personalized Investment Advice

- GoMyFinance Invest provides personalized recommendations based on your financial goals and risk tolerance.

- The platform’s tailored advice helps you make informed decisions, boosting your confidence as you navigate the world of investing.

- Beginner-Friendly Investment Platform

- With these features, GoMyFinance Invest is a great choice for new investors, offering a supportive environment to start and grow your investment journey.

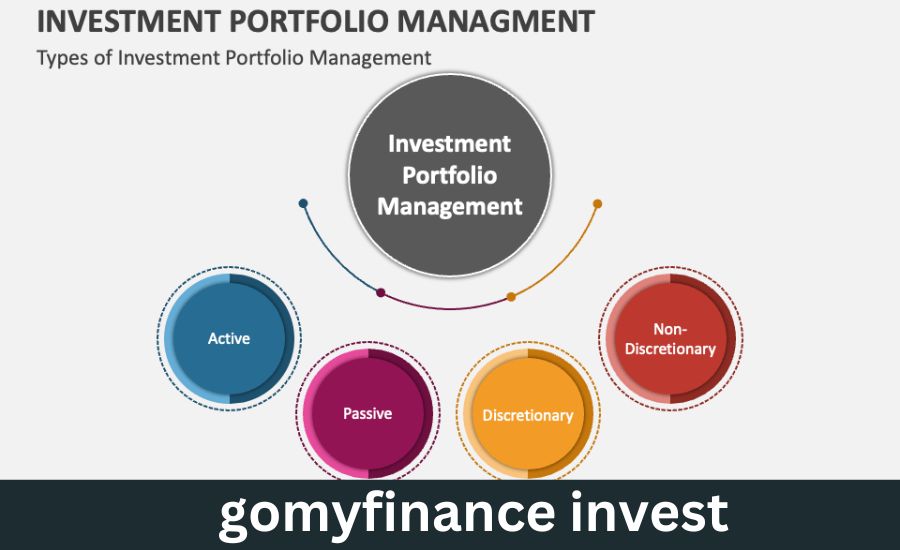

How GoMyFinance Invest Simplifies Portfolio Management for All Users

Managing an investment portfolio can seem daunting, but GoMyFinance Invest simplifies the process for everyone. The platform’s portfolio management tools are designed to help you keep track of your investments with ease. Whether you have a few stocks or a diverse range of assets, you can monitor everything from a single, intuitive interface.

One of the main features that simplify portfolio management is the automatic rebalancing tool. GoMyFinance Invest can automatically adjust your portfolio to ensure it stays aligned with your investment goals. This means that if one part of your portfolio grows faster than others, the platform will rebalance it to maintain your desired risk level. This feature is particularly useful for busy individuals who don’t have time to constantly monitor their investments.

Another aspect that makes portfolio management easier is the detailed reporting available on GoMyFinance Invest. The platform provides insights into your portfolio’s performance, breaking down which investments are doing well and where there might be room for improvement. These reports are clear and straightforward, making it easy to understand how your investments are performing over time. With these tools, GoMyFinance Invest ensures that managing your portfolio is both simple and effective.

Automated Investing with GoMyFinance Invest: Is It Right for You?

Automated investing is a feature that many investors are curious about, and GoMyFinance Invest offers a robust solution in this area. With automated investing, the platform takes care of selecting and managing investments on your behalf, based on the preferences you set. This hands-off approach is ideal for those who prefer a more passive investment strategy.

The first benefit of automated investing with GoMyFinance Invest is the convenience it offers. You set your investment goals and risk tolerance, and the platform handles the rest. This means you don’t have to spend time researching individual stocks or monitoring the market daily. For many people, this saves time and reduces the stress often associated with managing investments.

Another advantage is that automated investing helps to eliminate emotional decision-making. GoMyFinance Invest follows a consistent, data-driven approach to investing, which helps to avoid the common pitfalls of reacting to short-term market fluctuations. This can lead to more stable, long-term investment growth. However, it’s important to consider whether you’re comfortable with a fully automated approach or if you prefer having more control over your investment choices.

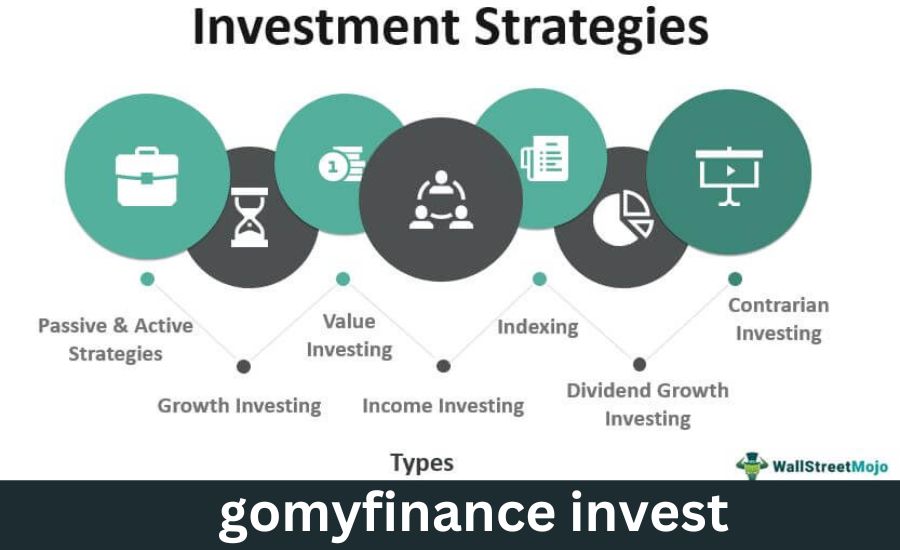

Personalizing Your Investment Strategy with GoMyFinance Invest

Customized Investment Strategy

- GoMyFinance Invest allows you to tailor your investment approach to align with your specific financial goals, whether you’re saving for retirement, a new home, or building wealth over time.

Goal-Based Recommendations

- The platform begins by asking questions about your financial goals and risk tolerance, then suggests an investment mix suited to your needs.

- You can choose from a variety of assets, including stocks, bonds, and ETFs, based on your risk preferences.

Flexible Strategy Adjustments

- As your financial goals evolve, GoMyFinance Invest lets you easily adjust your investment strategy.

- You can modify your asset allocation to become more aggressive or conservative at any time, ensuring your strategy stays aligned with your current financial situation.

Confidence and Control

- This personalized and flexible approach gives you greater confidence and control over your financial future, allowing you to invest with peace of mind.

Understanding the Diverse Investment Options on GoMyFinance Invest

When it comes to investment options, GoMyFinance Invest offers a wide variety to suit different needs. Whether you’re interested in stocks, bonds, ETFs, or mutual funds, the platform has something for everyone. Each type of investment comes with its own set of benefits and risks, and GoMyFinance Invest provides clear explanations to help you make informed choices.

For those looking to invest in stocks, GoMyFinance Invest offers access to a broad range of companies across various industries. This allows you to build a diversified portfolio that spreads your risk. If you prefer a more stable investment, bonds are also available, providing a fixed income over time. ETFs and mutual funds offer another option, combining multiple assets into a single investment that can provide diversification and professional management.

GoMyFinance Invest makes it easy to explore these options and choose the ones that best fit your investment strategy. Whether you’re a conservative investor looking for steady returns or someone willing to take on more risk for the potential of higher rewards, the platform’s diverse offerings ensure you can find the right investments for your needs.

Do You Read: Icryptox

Maximizing Returns: GoMyFinance Invest’s Tips for Smart Investing

Set Clear Financial Goals: Start by defining specific financial goals to guide your investment choices. Clear objectives keep you focused and motivated.

Diversify Your Portfolio: Invest in a variety of assets like stocks, bonds, and ETFs to spread risk and achieve more stable returns over time.

Use Personalized Advice: Utilize GoMyFinance Invest’s tailored recommendations to match your investments with your risk tolerance and financial goals, enhancing your potential returns.

Regularly Review and Adjust: Continuously monitor and tweak your investment strategy as needed to adapt to market changes and evolving financial goals.

Leverage Educational Resources: Take advantage of the platform’s educational tools to gain a deeper understanding of the market, enabling smarter investment decisions.

Stay Disciplined: Avoid impulsive decisions driven by market fluctuations. Consistent, long-term investing often leads to better outcomes than trying to time the market.

How GoMyFinance Invest Protects Your Financial Data: A Security Overview

Security is a top priority for GoMyFinance Invest, and the platform employs a range of measures to protect your financial data. From advanced encryption to secure login processes, GoMyFinance Invest ensures that your personal information is kept safe from unauthorized access. This commitment to security gives you peace of mind, knowing that your investments and data are well-protected.

One of the key security features of GoMyFinance Invest is its use of encryption technology. This technology ensures that all data transmitted between your device and the platform is securely encrypted, making it difficult for hackers to intercept or access your information. Additionally, GoMyFinance Invest requires strong, unique passwords for each account, further enhancing the security of your financial data.

In addition to encryption, GoMyFinance Invest also monitors accounts for any suspicious activity. If any unusual behavior is detected, the platform takes immediate action to protect your account, including sending alerts and temporarily freezing the account if necessary. With these comprehensive security measures in place, GoMyFinance Invest ensures that your financial data remains safe at all times.

Leveraging GoMyFinance Invest’s Financial Planning Tools for Long-Term Success

Comprehensive Financial Planning

GoMyFinance Invest provides robust financial planning tools to help you map out your long-term financial journey. These tools allow you to set and track goals, ensuring your investments align with your future aspirations.

Goal Tracking and Progress Monitoring

The platform enables you to monitor your progress toward financial goals, offering insights into how well your investments are performing in relation to your objectives.

Budgeting and Saving Features

Utilize budgeting tools to manage your spending and maximize savings. These features help you stay on track with your financial plan and ensure you’re consistently working towards your long-term success.

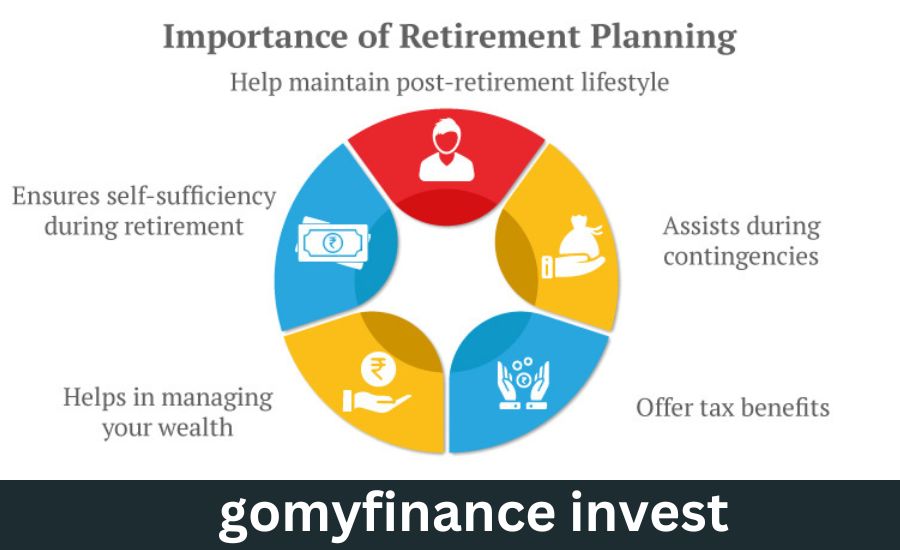

Why GoMyFinance Invest is the Ideal Platform for Retirement Planning

Retirement planning is a crucial aspect of financial security, and GoMyFinance Invest is an excellent platform to help you achieve your retirement goals. The platform offers a range of investment options and tools specifically designed for retirement planning, making it easy to build a retirement portfolio that suits your needs and risk tolerance.

One of the main benefits of using GoMyFinance Invest for retirement planning is the variety of investment options available. Whether you prefer to invest in stocks, bonds, or mutual funds, the platform provides a diverse selection of assets that can help you grow your retirement savings over time. Additionally, GoMyFinance Invest offers target-date funds, which automatically adjust your asset allocation as you approach retirement, reducing risk and providing peace of mind.

Another advantage of GoMyFinance Invest is its retirement planning tools, such as the retirement calculator and goal-setting features. These tools allow you to estimate how much you need to save and track your progress toward your retirement goals. By leveraging these resources, you can create a comprehensive retirement plan that ensures you’re on track for a secure and comfortable retirement.

Comparing GoMyFinance Invest to Other Investment Platforms: What Sets It Apart?

| Feature | GoMyFinance Invest | Other Investment Platforms |

| User-Friendly Design | Intuitive and easy to navigate | Varies; some may be less user-friendly |

| Personalized Advice | Tailors recommendations to individual goals and risk tolerance | Often uses a one-size-fits-all approach |

| Range of Investment Options | Offers a wide variety of assets, including stocks, bonds, and ETFs | Selection may be more limited |

| Educational Resources | Extensive resources including tutorials, articles, videos, and webinars | May offer limited educational content |

| Focus on New and Experienced Investors | Suitable for both beginners and seasoned investors | Some platforms may cater more to one group over the other |

The Role of Educational Resources in GoMyFinance Invest: Empowering Investors

Education is a key component of successful investing, and GoMyFinance Invest places a strong emphasis on providing educational resources to its users. These resources are designed to help you understand the fundamentals of investing, as well as more advanced concepts, so you can make informed decisions and build a successful investment strategy.

For beginners, GoMyFinance Invest offers tutorials and articles that explain basic investment concepts in simple, easy-to-understand language. These resources cover topics such as how to build a diversified portfolio, the importance of asset allocation, and the benefits of long-term investing. By learning these fundamentals, you can gain the confidence needed to start your investment journey.

For more experienced investors, GoMyFinance Invest provides advanced resources, including webinars and in-depth articles on topics such as market trends, investment strategies, and economic analysis. These resources help you stay informed about the latest developments in the financial world, allowing you to make more sophisticated investment decisions. With these educational tools, GoMyFinance Invest empowers all investors to take control of their financial futures.

How GoMyFinance Invest Supports Sustainable Investing: A Green Approach

Sustainable investing is becoming increasingly important for many investors, and GoMyFinance Invest supports this trend by offering a range of environmentally-friendly investment options. These options allow you to align your investments with your values, supporting companies and initiatives that are focused on sustainability and environmental responsibility.

One of the ways GoMyFinance Invest supports sustainable investing is by offering a selection of green ETFs and mutual funds. These funds invest in companies that are committed to reducing their environmental impact, such as those focused on renewable energy, clean technology, and sustainable agriculture. By choosing these investments, you can support businesses that are making a positive impact on the planet.

In addition to offering sustainable investment options, GoMyFinance Invest also provides resources to help you understand the benefits of green investing. The platform offers articles, videos, and tutorials that explain how sustainable investing works and why it’s important. By educating yourself about these options, you can make informed decisions that reflect your values and contribute to a more sustainable future.

Tracking Your Financial Progress with GoMyFinance Invest’s Analytics Tools

Monitoring your financial progress is crucial to achieving your investment goals, and GoMyFinance Invest makes this easy with its comprehensive analytics tools. These tools allow you to track your portfolio’s performance, assess your progress toward your financial goals, and make informed decisions about your investments.

One of the key analytics tools offered by GoMyFinance Invest is the portfolio tracker. This tool provides a detailed overview of your investments, showing how each asset is performing and how your portfolio is balanced. With this information, you can see which investments are contributing to your financial goals and which may need to be adjusted.

In addition to the portfolio tracker, GoMyFinance Invest also offers goal-tracking features that allow you to monitor your progress toward specific financial objectives. Whether you’re saving for retirement, a new home, or a child’s education, these tools help you stay on track and make adjustments as needed. By regularly reviewing your financial progress, you can ensure that your investments are aligned with your goals and continue to move you closer to achieving them.

The Benefits of Regular Investment Reviews with GoMyFinance Invest

- Stay Informed About Performance

- Regular reviews with GoMyFinance Invest provide detailed reports on your portfolio’s performance, helping you understand how each asset impacts your overall financial picture.

- Identify Areas for Adjustment

- Reviewing performance reports helps you pinpoint any underperforming assets or areas needing attention, allowing you to make timely adjustments to keep your investments on track.

- Ensure Alignment with Financial Goals

- As your goals change, GoMyFinance Invest allows you to easily adjust your portfolio, ensuring that your investments remain suitable for your evolving needs.

- Maintain a Successful Investment Strategy

- Conducting regular reviews helps you stay proactive in managing your portfolio, supporting your long-term financial goals and maintaining an effective investment strategy.

Conclusion

In conclusion, GoMyFinance Invest is a fantastic tool for anyone looking to grow their savings and reach their financial goals. With its easy-to-use features, helpful advice, and many investment options, it’s perfect for both beginners and experienced investors. Whether you’re saving for a big purchase, planning for retirement, or just want to make your money work harder, GoMyFinance Invest can guide you every step of the way.

Plus, GoMyFinance Invest offers great tools to track your progress and make smart decisions about your money. You can see how well your investments are doing and make changes whenever you need to. By using GoMyFinance Invest, you’re not just saving money—you’re building a secure future for yourself and your family.